The Growth of the Automotive Semiconductor Industry for Smart Cars

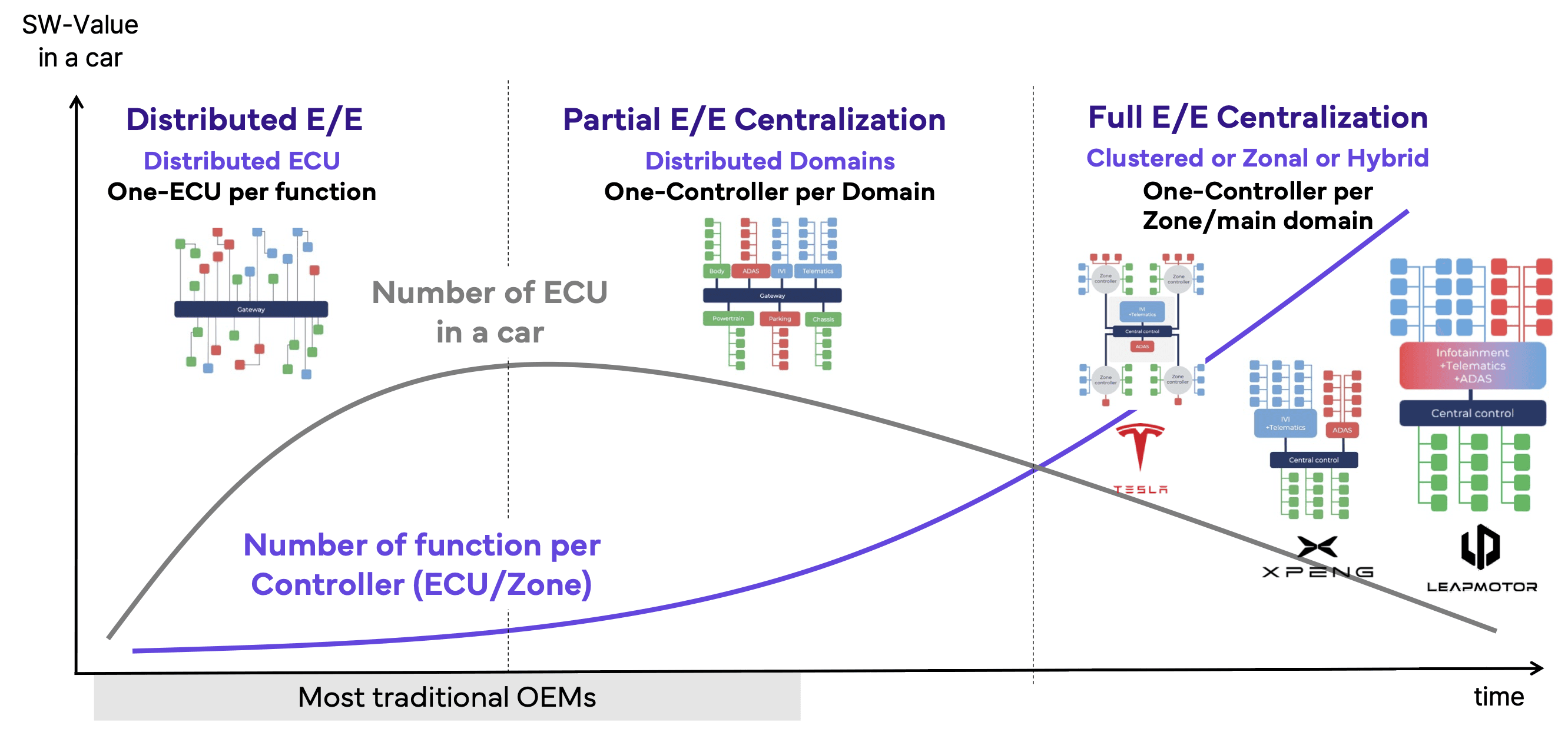

Evolution in the number of ECUs per car and the number of functions per controller (Source: Yole Intelligence)

1. Rapid Growth in the Automotive Semiconductor Market: Centralization and the Emergence of Generative AI

Growth of the Automotive Semiconductor Market

In 2023, global semiconductor sales decreased by 8.2%, from $574.1 billion in the previous year to $526.9 billion. However, sales have gradually rebounded since the second half of 2023, showing a steady upward trend. One of the key drivers of this recovery has been the growth in sales in the automotive and industrial sectors1. Notably, the global automotive semiconductor market was valued at $15.3 billion in 2022, accounting for 2.6% of the total semiconductor market. By 2023, it surged to $20 billion, representing 3.7% of the total market 2.

The automotive semiconductor market is broadly divided into Micro-Controller Units (MCUs) and Application Processor Units (APUs). MCUs are primarily used to control hardware in the vehicle, such as the powertrain and body, while APUs are mainly applied to advanced electronic systems such as Advanced Driving Assistance Systems (ADAS) and In-Vehicle Infotainment (IVI) systems. As the electrification of vehicles accelerates and autonomous driving technology advances, the automotive computing semiconductor market is experiencing rapid growth. Particularly, sales in the APU sector saw significant growth, increasing from 39% of the total automotive computing semiconductor revenue in 2022 to 53% in 2023, with the growth of ADAS-related APUs being especially prominent 2.

ADAS: The Need for High-Performance Semiconductors for Centralization and AI Algorithm Processing

ADAS (Advanced Driving Assistance Systems) play a crucial role in maximizing driver safety and convenience through the integration of various advanced technologies and systems. These systems use sensors such as cameras, radar, and LiDAR to monitor the surrounding environment in real-time, detecting obstacles, pedestrians, and road conditions to assist drivers. Representative functions of ADAS include lane keeping, collision prevention, automatic emergency braking, parking assistance, and rearview monitoring. Each function operates based on data collected by relevant sensors and is processed in real-time by AI-based software, such as machine learning and deep learning algorithms. The analyzed information is transmitted to the vehicle’s Electronic Control Unit (ECU), which controls key hardware components like brakes and steering. Furthermore, ADAS software can be connected to cloud systems or servers for continuous learning and updates, reflecting the latest traffic information and road conditions.

ADAS is a crucial step towards fully autonomous driving technology. Most global OEMs have reached Level 2 autonomous driving, with some OEMs, especially Tesla and Chinese electric vehicle manufacturers like Nio, Xpeng, and Li Auto, releasing Level 2+ vehicles capable of hands-off driving under certain conditions. However, as of August 2024, only a few manufacturers, including Mercedes-Benz, Honda, and BMW, have mass-produced vehicles with Level 3 or higher autonomous driving, which includes eyes-off driving capabilities. The development of autonomous vehicles remains a key goal in the mobility roadmaps of most OEMs, and more advanced autonomous vehicles are expected to enter the market in the future.

As autonomous driving technology progresses, the amount of data that vehicles need to process increases exponentially, limiting the traditional method of processing data separately in individual ECUs assigned to each sensor. To efficiently handle large volumes of data, integrated domain controllers are essential. These centralized ADAS architectures process data from multiple sensors in real-time, improving the accuracy and reliability of autonomous systems. Moreover, advancements in ADAS architecture are becoming a key factor in the evolution of autonomous driving technology.

Infotainment: Centralization of Cockpit Processors and Implementation of Generative AI

As electrification and smart technologies emerge as key trends in the automotive market, customers are increasingly prioritizing advanced safety features and driver/passenger convenience over vehicle performance when making purchase decisions. Just as ADAS offers a variety of safety functions, IVI (In-Vehicle Infotainment) and telematics systems provide features that maximize convenience during driving. These features are housed in the vehicle’s cockpit, which, like ADAS, is undergoing a shift towards centralization under a single domain controller.

The cockpit serves as the primary interface where drivers and passengers experience various safety and convenience features. Global OEMs are focusing on providing user experiences similar to smartphones through high-resolution displays and in-vehicle voice assistant functions. In particular, major global OEMs are applying cloud-based generative AI to vehicles to enable real-time interaction between the driver and the vehicle, offering personalized convenience features that respond to customer demands. For example, Volkswagen has integrated ChatGPT into its system, while Nio has implemented its proprietary voice service solution, Nomi, enhanced with generative AI, to elevate the user experience.

This section explains the rapid growth of the automotive semiconductor market driven by increasing vehicle electrification and advancements in autonomous driving technologies. It emphasizes the role of high-performance semiconductors in ADAS, centralization of vehicle architectures, and the use of AI-based technologies in cockpit systems. Let me know if you’d like the rest of the document translated.

Centralization of Vehicle-Level Electrical/Electronic (E/E) Architecture and the Need for High-Performance Automotive Semiconductors

The introduction of domain-specific integrated controllers, such as for ADAS and IVI, has accelerated the centralization of vehicle-level electrical/electronic architecture, promoting a shift from the traditional distributed structure to a domain-based architecture. In particular, ADAS, which collects and processes vast amounts of data through computer vision, necessitates high-performance computing processors, making it a key driver of the centralization of electrical/electronic architectures. Furthermore, emerging electric vehicle OEMs have set their sights on software-centric vehicles from the early stages of development, maximizing the efficiency of data collection and processing while designing vehicle architectures optimized for power management. Notable examples include Xpeng’s Clustered Domain Architecture and Tesla’s Zonal Architecture. While the adoption of centralized electrical/electronic architectures has reduced the number of ECUs within the vehicle, the scope of functions handled by each ECU has expanded significantly. As a result, the application of high-performance automotive computing semiconductors, which offer greater computational power, has become essential.

The Application and Evolution of AI Algorithms in Vehicles

In vehicles equipped with high-performance processors, the computation and processing of AI algorithms have become feasible, enabling the realization of advanced ADAS functionalities and autonomous driving capabilities. Notably, parallel processing through Graphics Processing Units (GPUs) and Neural Processing Units (NPUs) has significantly enhanced computational speeds, thereby maximizing the practical utility of AI. For instance, Tesla optimized the processing of its proprietary AI algorithms by primarily applying NPUs to its ADAS processors. In contrast, Nvidia’s Orin automotive SoC (System-on-Chip) predominantly utilizes GPUs to efficiently process a variety of AI algorithms, tailored to meet the needs of OEMs.

While ADAS primarily handles the computation of AI models specialized in processing image data, the cockpit incorporates generative AI based on large language models (LLM), providing more advanced convenience features for both drivers and passengers. For example, Xpeng offers personalized convenience features through its intelligent voice assistant “Xiao P,” which utilizes a cloud-based AI model powered by LLM to engage in conversations with drivers.

Changes in the Automotive Semiconductor Ecosystem and the Importance of Strategic Relationships with OEMs

Automotive semiconductors are a key component of software-centric vehicles and play a crucial role in determining a vehicle brand’s electrification capabilities. The choice of semiconductor dictates the vehicle’s architecture and software, meaning that changing a semiconductor supplier is both highly difficult and costly. Consequently, OEMs naturally become more reliant on semiconductor suppliers, making strategic partnerships essential for price negotiations and securing the supply chain. In contrast, some electric vehicle OEMs, including Tesla and a few Chinese manufacturers, are developing proprietary semiconductors to reduce this dependency and apply their own technology to their vehicles. However, this approach not only incurs significant costs but also requires the technical expertise and resources to compete with leading semiconductor design companies, making it a challenging endeavor.

In particular, ADAS processors require exceptionally high computational power among automotive semiconductors, and their performance is often seen as a symbol of the technological prowess of the vehicle brand. Leading companies in this space include Mobileye and Nvidia. As of 2023, Mobileye led the ADAS vision processor market, accounting for nearly half of the $4.1 billion global ADAS processor sales 2. Some of its major global OEM partners include BMW, VW, and Stellantis. Nvidia holds an 11% share of the overall ADAS processor market and, alongside Tesla, dominates the central processor market for ADAS. Nvidia continues to supply high-performance semiconductors and aims to eventually provide a single chip that handles all ADAS-related functions. It currently supplies chips to Mercedes-Benz and several Chinese EV OEMs, including Nio, Xiaomi, Xpeng, and BYD.

In the cockpit processor domain, Qualcomm led the global market in 2023 with a 29% share 2. Qualcomm has not only excelled in cockpit applications but also made a strong impact in the connectivity sector, expanding its supply to most global OEMs. With this technical prowess, Qualcomm is gradually extending its expertise into the ADAS processor field, strengthening its dominance in the automotive processor market and increasing OEM dependency.

Meanwhile, the development of integrated processors capable of handling both ADAS and IVI functions on a single chip is gaining momentum. One technical challenge in this process is integrating an ADAS processor, which requires higher computational power to meet ASIL-D safety certification standards, with an IVI processor that only needs to meet the relatively lower ASIL-B certification. A prominent example is Leapmotor’s Four-Leaf Clover platform, and Qualcomm has also announced the development of a processor architecture capable of integrating ADAS and IVI functions. Qualcomm’s technological advancements signal a stronger grip on the automotive semiconductor market.

Furthermore, collaborations among semiconductor companies to effectively implement generative AI computational capabilities in vehicles have begun. In March 2023, Nvidia and Mediatek announced a strategic partnership to integrate Nvidia’s GPU chiplets with Mediatek’s SoCs. This collaboration aims to power automotive SoCs with Nvidia’s automotive operating system and its parallel processing platform, CUDA, to offer a solution that integrates and manages both ADAS and cockpit functions via AI.

Formation of Strategic Relationships Between OEMs and Automotive Semiconductor Companies

Global OEMs are strengthening strategic collaborations with automotive semiconductor companies, identifying batteries and semiconductors as key components in response to the rapidly evolving automotive market. The production disruptions caused by global supply chain failures during the COVID-19 pandemic underscored the critical importance of sustainable supply chain management for OEMs. As a result, establishing close partnerships with major component suppliers has become essential for OEMs.

OEMs’ supply chain management strategies can be divided into external sourcing and internal production. Batteries and semiconductors, two of the most expensive components of electric vehicles, are essential. While OEMs often have plans to produce their own batteries, semiconductors are an item that must be externally sourced. In this context, ensuring price competitiveness and securing a stable supply chain has become a top priority for OEMs. To achieve this, OEMs prefer to source ADAS and IVI processors from multiple suppliers. As a result, the importance of close strategic partnerships between OEMs and semiconductor companies has become more prominent. Through these relationships, OEMs can ensure both competitive pricing and a secure supply chain.

The Volkswagen Group has designated batteries and automotive semiconductors as critical components, establishing a dedicated strategic procurement management division internally to focus on securing supply stability and price competitiveness. To achieve this, the group holds regular meetings and maintains close communication with battery and semiconductor suppliers to share updates on component development, project status, and OEM purchasing strategies. Notably, Audi has represented the Volkswagen Group in hosting an annual “Semiconductor Summit” since 2022. This event invites major automotive semiconductor suppliers, as well as Tier 1/2 partners, to participate. The summit aims to build a flexible and resilient semiconductor supply chain from the OEM’s perspective. By sharing the OEM’s semiconductor specifications in advance, suppliers can secure profitable product lines, ultimately ensuring a stable semiconductor supply and establishing long-term cooperation with suppliers.

Key Takeaways: What is necessary for Successful Global Business in Automotive Semiconductors

With the demand for high-performance automotive semiconductors surging, opportunities for semiconductor companies with advanced technology, quality, price competitiveness, and strategic collaboration potential are expanding in the global market. Especially for OEMs, the ability to implement high-performance semiconductors capable of processing AI algorithms has become a crucial criterion for selecting partners, as these technologies symbolize the OEM’s prowess in automotive electronics. However, the introduction of high-performance semiconductors often results in price increases, making price competitiveness more critical than ever.

In Europe, for instance, rising energy costs and inflation driven by the Russia-Ukraine war have put sustained pressure on suppliers to reduce costs. Under this environment, it is essential for suppliers to enhance the price competitiveness of their products through technology development while also optimizing the costs of logistics and procurement processes. This is particularly important for global suppliers, who must maintain supply chain stability while improving price competitiveness.

Moreover, the importance of long-term strategic collaboration between OEMs and semiconductor suppliers is becoming increasingly apparent. OEMs often require custom-made semiconductors tailored to vehicle specifications, so trust-based networking with these companies can lead to joint development or strategic partnerships. Since high-performance semiconductors represent a relatively new domain for many OEMs, they tend to favor collaborations that go beyond only component supply. These OEMs prefer partnerships based on continuous communication with suppliers, fostering both technical and business understanding. (04.10.2024)

This article is a part of my contribution article on the KOTRA expert publication. (Link)